QuickBooks error 179 arises from an authorization failure that blocks access to company data, typically when connectivity between the accounting software and your bank’s servers is disrupted. Without this critical handshake validating account access rights, Error 179 appears concerningly alongside “Unable to open company file” alerts. Left unresolved, the issue risks corrupting sensitive company files over time. While highly disruptive for business owners, rest assured, QB Error 179 can be quickly fixed by updating to the latest QB version supporting modern bank data formats. Alternatively, restoring lost server connections allows the revalidation of user permissions. Seek Intuit’s specialized troubleshooting help promptly to enable fast authorization fixes before company data sustains permanent damage from authorization denial.

How to Resolve QuickBooks Error Code 179?

QuickBooks Error Code 179 arises from an authorization issue blocking access to vital company data. Typically, Error 179 appears when connectivity between your accounting software and the bank servers is lost, preventing user access rights validation. Left unchecked, the issue can escalate to unrecoverable data corruption over time – highly concerning for business owners. The excellent news is QuickBooks 179 is easily resolvable. Updating to the latest QB version often fixes compatibility issues, recognizing current bank data formats. Specialized troubleshooters can also quickly restore lost server connections, enabling the seamless revalidation of user permissions. It is critical to address Error 179 authorization failures immediately through expert fixes before company files sustain permanent damage from recurring access denials. Timely resolution steps get business data access back on track.

Preceding Causes of the QuickBooks Fatal Error 179?

QuickBooks error 179 fundamentally stems from discrepancies in financial data. Here are the critical triggers behind this blocking access error:

- Errors During Data Reconstruction – Running the Rebuild Data utility could further corrupt already inaccurate data, manifesting Error 179

- Missing Transactions – Critical transactions gone missing from the database damage data integrity required for user authorization.

- Incorrect Balance Sheet Dates – Improper dates associated with accounting records confuse authorization sequencing, leading to Error 179

- Loss of Company Files Access – With raw data unavailable from local or hosted storage, QuickBooks cannot validate credentials, triggering errors.

- Faulty Payment Receipt Screens – Glitches in payment matching screens inside QuickBooks interrupt authorization protocols.

- Data Discrepancies in Accounts – If balance sheets have inaccurate or missing accounts, access failures result from incomplete data.

- Problems in Financial Reports – Since Error 179 stems from insufficient data, any expenses/revenue issues manifest authorization errors.

- Corrupted Windows Registry – Technical system level damage like crashed Registry interrupts QuickBooks functioning, provoking fatal errors.

By proactively monitoring data quality, fixing technical issues, and preventing data loss, the frustrating authorization and access Error 179 can be readily avoided by unlocking seamless QuickBooks access.

Signs of the QB Error 179

- Company File Inaccessibility – The primary symptom is the inability to open or access the company file database.

- Data Disappearance – Critical company data transaction records suddenly go missing, indicating corruption.

- Input Failures – The QuickBooks application stops accepting or responding to any user inputs, signaling fatal errors

- Severe Sluggishness – With data access disrupted, overall Windows system performance slows to a crawl.

- Application Crashes – Error 179 can frequently culminate in sudden and unforeseen QuickBooks Desktop application shutdown.

- Emergence Of Erroneous Values – Data damage from Error 179 shows up through incorrect or nonsensical values for transactions and accounts

Rather than waiting for multiple visible symptoms, it is prudent to catch and address Error 179 at first instance through expert help before irrecoverable company file corruption sets in.

Methods to Fix QuickBooks Error 179

Log Out of All Browsers

- Step 1: Log out from every browser or device currently accessing the bank website

- Step 2: Ensure nobody else is logged into the bank site with your credentials. If found, log them out

- Step 3: Re-enter banking credentials within QuickBooks software

- Step 4: Attempt accessing the bank site again

QB Error 179 arises from connectivity issues during bank authentication to validate access rights. Simultaneous logins from multiple browsers can confuse authentication, blocking access with “Unable to open company file” errors. Logging out of all active sessions clears this conflict, allowing a clean authentication check between QuickBooks and banking servers using proper credentials. With no clashes from overlapping logins, the validation can now smoothly occur, granting rightful QuickBooks access to authorized users. Remember to never share bank account login credentials across devices or users to prevent authentication overlaps from blocking access.

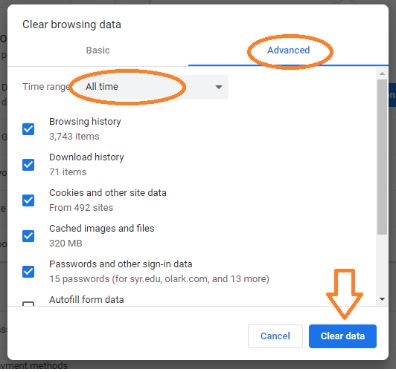

Delete Browsing History to Fix Error 179

- Step 1: Launch an internet browser

- Step 2: Go to Settings > More options

- Step 3: Click “Delete browsing data” in settings

- Step 4: Select all options like Cache History for clearing

- Step 5: Allow time for deleting all browsing data from the system

- Step 6: Relaunch the browser and attempt bank site access again

Over time, browser cache, cookies, and history collected from accessing the bank server can get outdated or corrupted, causing authentication failures and blocking access. Wiping this browsing data entirely makes QuickBooks-bank connectivity start fresh, enabling updated validation checks without the clutter of old confused records leading to 179. The clean handshake confirms updated access permissions correctly, fixing authorization issues smoothly.

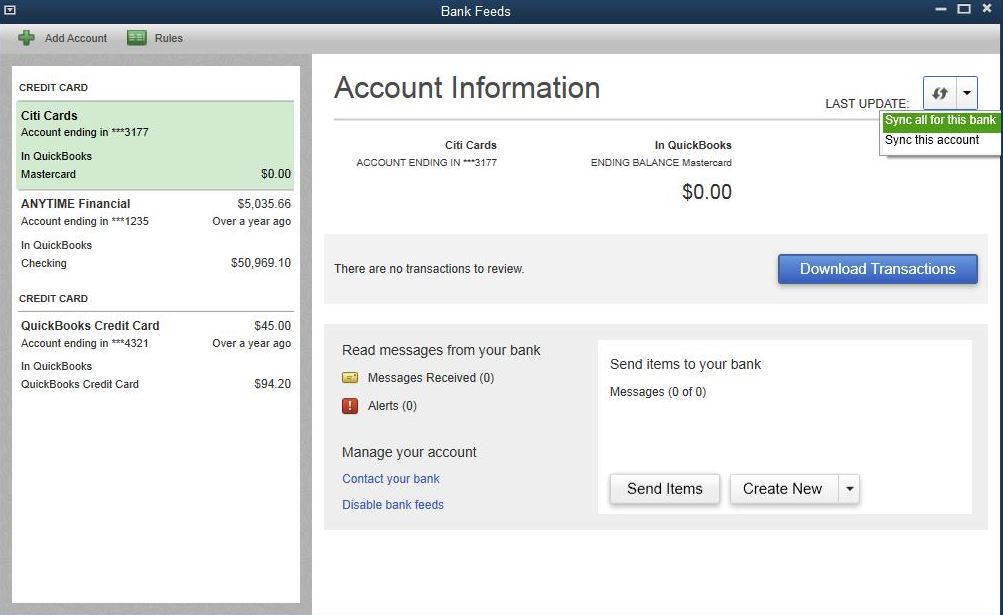

Update Bank Account Info to Resolve Error 179

- Go to QuickBooks Tools > Online Center > Select your Bank

- Press Ctrl + F3 keys together to open the background window

- Click “Contact Info” and choose Bank again

- Click the “Refresh” button and then “Update.”

- Enter the admin password if prompted

- Click “B” to begin the bank details update

- Let the update complete

- Check if Error 179 persists

QuickBooks Error 179 stems from connectivity failure during bank authentication restricting access. Updating bank account data registered in QuickBooks software allows a smooth handshake for validating user permissions. Refreshed details match correctly at both ends, successfully confirming account access rights to fix frustrating 179 errors that earlier blocked access due to outdated mismatching details.

Restore With QuickBooks Backup Authorization Key

When all troubleshooting options are exhausted, you can override Error 179 by restoring clean authorization components from the QuickBooks Backup key – Open Windows Command Prompt and launch Regedit, navigate to the QuickBooks folder to select the Error 179 entry, and export this data out. Next, automatically import the previously stored Backup Authorization Key file and click OK to overwrite the corrupted authorization aspects, triggering error messages.

QB Error 179 -The Information Might be Helpful

QuickBooks Error Code 179, stemming from bank authentication failures, should be promptly fixed before causing more significant disruptions. The step-by-step troubleshooting guide outlined here, encompassing information refreshes, browser resets, data backups, and expert assistance, should help address the root causes behind authorization errors. With robust solutions available, Error 179 can be smoothly resolved, allowing normal access to be restored quickly without blocking workflows or risking data damage. In case of any questions or are unable to resolve the issue, please don’t hesitate to contact our QuickBooks error support team at 1-888-656-2102 for assistance.