Upgrading QuickBooks to the latest version

Staying updated with the latest QuickBooks version ensures access to new features, enhanced security, and seamless integrations. Upgrading helps you avoid service interruptions for Payroll, Payments, and bank feeds while keeping your data safe with the latest security patches. It also grants you access to live technical support, ensuring smooth operations if issues arise.

Top Rated QuickBooks Solution Provider

QuickBooks File Issues

QuickBooks Data Conversion

How does QuickBooks Payroll work?

QuickBooks Payroll’s reporting capabilities allow organizations to examine payroll spending, track costs, and generate reports. QuickBooks makes it easy to connect to other products, guaranteeing smooth data transmission and accurate reporting.

With QuickBooks, Complete Payroll Management

Paycheck Generation

Simple steps for successful tax compliance

Benefit Management QuickBooks are available online

QuickBooks provides custom reports and analysis

Advantages of QuickBooks Payroll

Effectively streamline payroll management for businesses of all sizes with features designed to simplify the complex task of paying employees accurately and on time.

Automated Payroll Processing:

Tax Compliance with QuickBooks:

Customized Payroll Reports:

Integration of QuickBooks Accounting:

Payroll Pricing and Plans

Features like automatic tax calculations, easy employee onboarding, and direct deposit make managing your business's payroll more accessible.

QuickBooks Payroll Basic

- Full-service payroll

- Auto Payroll Includes automated taxes & forms

- Same-day direct deposit

- Expert review/ Expert product support

- 24/7 expert product support/

- Workers’ comp administration HR support center

- Technical support center

Online Payroll Premium

- Full-service payroll Includes automated taxes & forms Auto Payroll

- Expert product support

- 24/7 expert product support Expert review

- HR support center

- Workers’ comp administration

- Enhanced Security

- Income and expenses

- Invoice and payments

- Tax deductions

- General reports

- Mileage tracking

- Cash flow

- Sales and sales tax

- Connect all sales channels

- Free guided setup

- Bill management

- Inventory

- Project profitability

- Connect all sales channels

Payroll Premium Plus

- Full-service payroll with Includes automated taxes & forms Auto Payroll

- Expert product support

- Same-day direct deposit

- Expert review with 24/7 expert product support

- Workers’ comp administration

- Enhanced Security

- Income and expenses

- Invoice and payments

- General reports

- Tax deductions

- Mileage Cash flow and tracking

- Sales and sales tax

- Bill management and Free guided setup

- Inventory

- Project profitability

- Technical Support 24*7

- Connect all sales channels and Free guided setup

Payroll Customer Service and Support of QuickBooks

QuickBooks provides various payroll options to suit the needs of different businesses, including managing QuickBooks Online Payroll and QuickBooks Desktop Payroll.

Is QuickBooks free for payroll?

QuickBooks offers several payroll services, but they are not free. While QuickBooks Online does provide a payroll feature, it comes at a regular cost, with different pricing tiers depending on your business needs. Although there may be occasional promotions or free trials, these services are generally not accessible in the long term. The benefits QuickBooks payroll may bring to your business given that it streamlines the payroll process, calculates taxes, and ensures compliance, potentially saving you time and reducing expensive errors.

- QuickBooks Payroll is designed with user-friendliness. Even if you’re not a financial expert, you can easily navigate the platform and manage your payroll without feeling overwhelmed.

- It automates many payroll tasks, saving you manual calculations and data entry hours. This means you can focus more on growing your business and less on administrative work.

- The software reduces the risk of human errors in payroll calculations. This helps you avoid costly mistakes and potential legal issues related to payroll compliance.

- QuickBooks offers a range of features, from basic salary calculations to more complex tasks like tax calculations and compliance with local regulations. It can adapt to the exact needs of your business.

- Provides customer support and a wealth of online resources, including tutorials and guides, to assist you whenever you have questions or encounter issues.

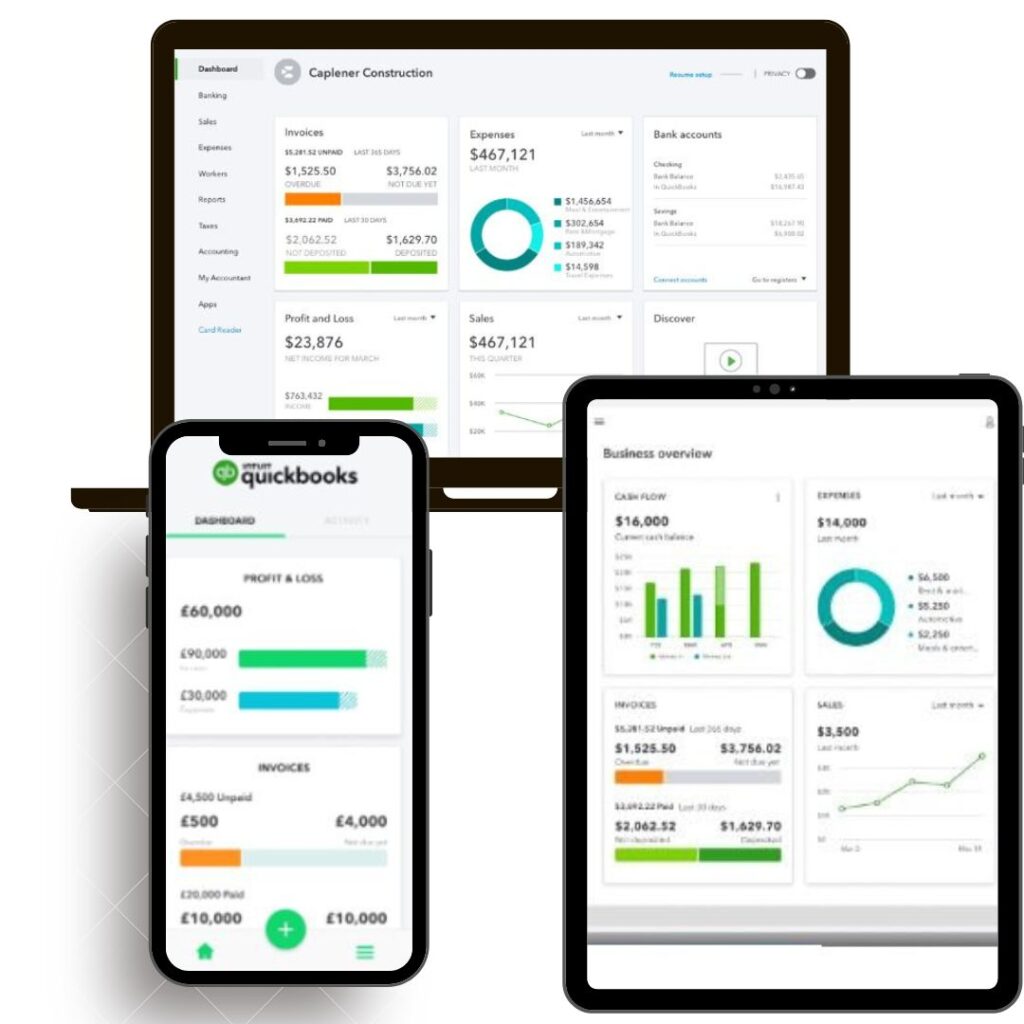

- You can manage your payroll using the mobile app. This flexibility is precious for busy business owners who are constantly on the move.

- Simplicity and Ease of Use QuickBooks Payroll is designed with user-friendliness. Even if you’re not a financial expert, you can easily navigate the platform and manage your payroll without feeling overwhelmed.

Disclaimer

All licenses are issued directly by Intuit. PGS SMART SOLUTIONS LLP is an authorized ProAdvisor for all Intuit products. PGS SMART SOLUTIONS LLP is an Intuit®️ Certified ®️ ProAdvisor®️ for certain Intuit®️ products. The Intuit®️logo, Intuit®️, ®️, ProAdvisor®️, are the registered logos, trademarks, and brand names of Intuit Inc and are mentioned on this website are solely used for reference purpose as per Intuit®️ Certified ®️ ProAdvisor®️ agreement. Other third-party logos are used for reference purposes only and belong to their respective owners. We assume no liability or responsibility for any errors in the content of this website or such other materials.

About us

Customer Service

- Services

- Contact us

- Faq

Contacts

Visit Us

1805 SUNNYVIEW OVAL

KEASBEY, NEW JERSEY 08832

USA

Plot no-22 W Z-5A, Vishnu Garden, Tilak Nagar, S.O. West Delhi, India-110018

Quick Pro Advisor

Copyright © 2024 All rights reserved.